Über-warehouses for the ultra-rich

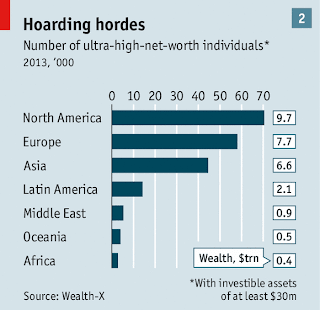

"Tell Jeeves to pull the jet around, I have some art to drop off in Luxembourg." If you are anything like me these words are not uttered frequently in your house but for ultra-high net worth individuals warehousing in "tax friendly" countries is becoming increasingly popular. Maybe after completing our UW MBA program we will be able to join the ranks of the ultra-rich, now estimated at 199,235 individuals with assets over 30 million dollars. Individuals like this are the target of the new Freeport model. Staged at traditional airports, these uber warehouses offer attractions similar to banking attractions to offshore financial institutions. Low levels of scrutiny, the ability of owners to hide behind nominees, and an array of tax advantages.

Because of the confidentiality, no one knows what the heck the value of goods stashed in freeports actually is. Currently it is thought to be in the hundreds of billions of dollars, and always increasing. A lot of what lies in these super secure airport warehouses is perfectly legitimate, but the protection offered from scrutiny ensures that they appeal to tax-dodgers. Freeports have been among the beneficiaries of the undeclared money, precious metals and valuable property flowing out of the US and Europe. Most of the data and graphs in the article serve to substantiate the claim that the reason the wealthy put their money into gold, art, and other collectibles is that it has been a better investment over the last 25 years.

Prices for vintage wine, fine art, rare stamps, precious coins and even classic guitars and violins have outpaced the market. The Economist has compiled recognized indices for each of these assets to create a valuables index. They have weighted each asset in the index according to rich individuals’ holdings, as reported by the wealth-management arm of Barclays: 36% fine art, 25% classic cars, 17% coins, 10% wine and 6% stamps. In this blended index the return has been over 210%. This has created new investment funds based on Guitars, stamps, classic cars and more.

I thought this was an article about how wealthy people spend money and shelter it but what it really taught me was about the new options in collectible funds. With a Beta of nearly 2 on average these collectible items, if valuable and rare creates a new and interesting opportunity for investing. The average person cannot afford to purchase a Van Gough or a classic Les Paul Guitar but they could buy into shares of collectible funds.

No comments:

Post a Comment